Texas Job Growth Fuels Strong Investor Interest

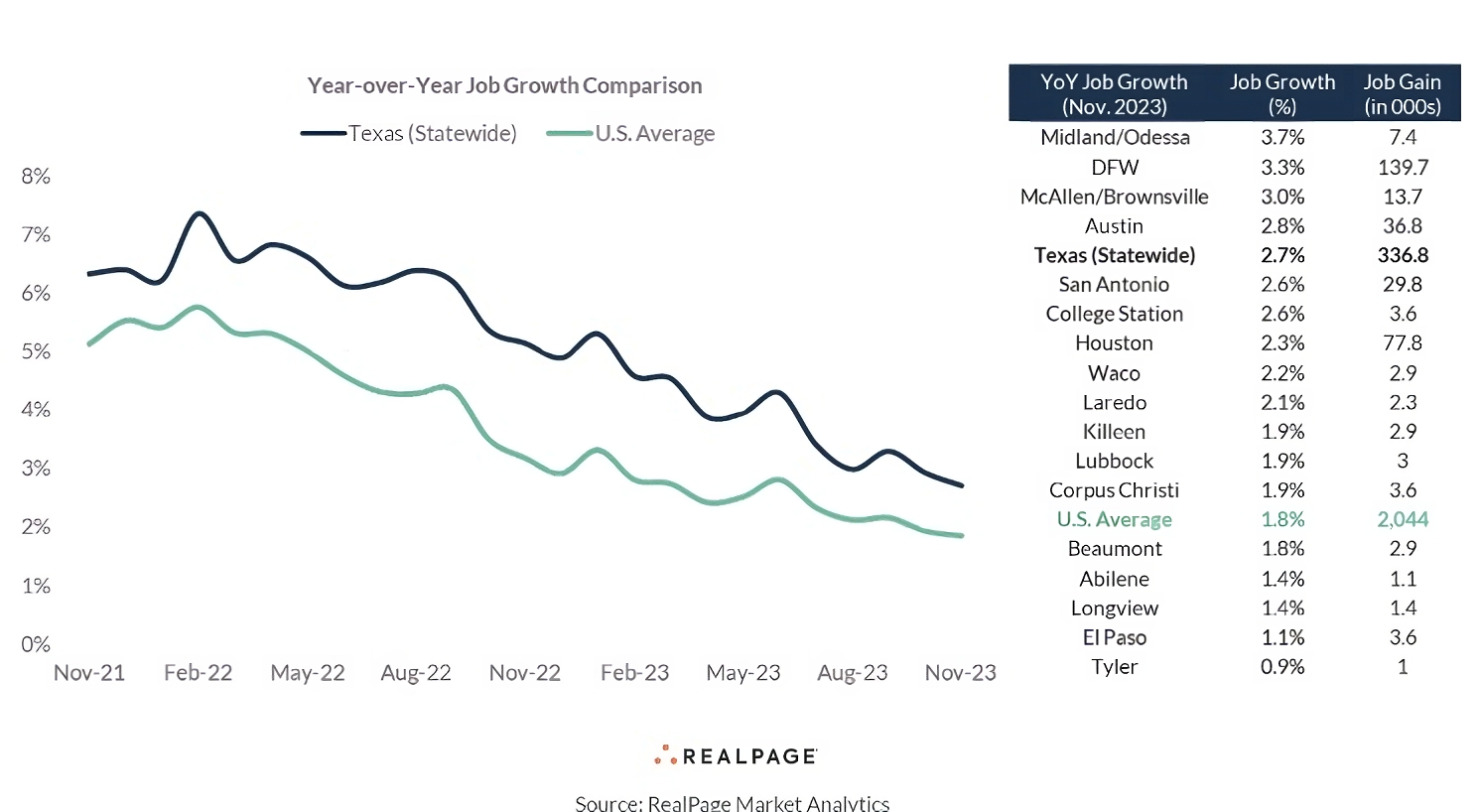

Texas continues to be a powerhouse in job creation, outpacing national employment standards with 336,800 jobs added in the year-ending November, reflecting a remarkable 2.7% increase. This robust performance, well ahead of the U.S. average of 1.8%, positions Texas metros prominently in the national job growth landscape. Notable standouts include Midland/Odessa ranking 15th, Dallas/Fort Worth ranking 20th, and other cities like McAllen/Brownsville, Austin, San Antonio, and College Station securing positions in the top quartile nationally. This strong job growth, a precursor to solid household formation, has propelled significant apartment demand in key Texas markets, particularly Houston, Austin, and Dallas.

Bureau of Labor Statistics data underscores Texas’ exceptional job growth, reinforcing its reputation as an economic hub. The state’s resilience in the face of the broader economic slowdown is a testament to its robust employment market.

Evergreen Capital highlights the compelling link between strong job growth and increased household formation, emphasizing the potential for sustained demand in the Texas real estate market. The firm advises investors to closely monitor the thriving job markets in Texas, particularly in Houston, Austin, and Dallas, as they present favorable conditions for real estate investment. The correlation between job growth and apartment demand underscores the resilience of these markets, offering investors valuable opportunities in the evolving economic landscape.

In conclusion, Evergreen Capital encourages investors to consider the dynamic job market in Texas as a key factor in their investment strategy, leveraging the state’s economic strength for potential long-term returns. The firm’s insights position Texas as a strategic focus for investors seeking stability and growth in the real estate sector.