May 2025 Newsletter

- Retail CRE Positioned to Withstand Potential Headwinds

- Multifamily Market Hits Two-Year Low in Vacancy Rates

- Colliers Identifies Early Indicators of a New Investment Cycle in Commercial Real Estate

- CRE Distress: A Trickle, Not a Wave — Strategic Insights for 2025

- Condo Market Faces Investor Caution Amid Economic Headwinds

April 2025 Newsletter

- Market Mayhem: Trump’s Tariffs Shake Commercial Real Estate

- Commercial Real Estate at a Crossroads: Navigating the Surge in Loan Modifications

- The U.S. Apartment Landscape in 2025: Bigger Spaces, Brighter Futures

- The Aging Backbone of American Housing: A Call to Action

- U.S. Apartment Occupancy Trends in 2025: A Market-by-Market Breakdown

March 2025 Newsletter

- Commercial Real Estate Prices Show Signs of Stabilization Amid Rate Cuts

- Embracing AI: A New Era for Real Estate

- U.S. Multifamily Firms Poised to Benefit Amid Trade War Dynamics

- Navigating the Evolving Landscape of Property Insurance and Risk Management

- D.C. Council Considers Permanent Eviction Law Reforms Amid Landlord Opposition

February 2025 Newsletter

- The Impact of Tariffs on Commercial Real Estate:

Challenges and Opportunities - Freddie Mac Projects Multifamily Loan Origination Growth

Despite High Rates and Vacancies - Multifamily Deals Face Headwinds Amid Interest Rate

and Supply Concerns - 2025 Apartment Demand Outlook: What’s Fueling

Growth in a Slowing Job Market? - 2025 U.S. Housing Market Outlook: A Year of

Opportunity Amidst Challenges

January 2025 Newsletter

- Q4 2024 Commercial Real Estate Market Trends:

Resilience Amid Market Shifts - Robust Apartment Absorption Forecasted for 2025

- Major Job Growth Projected for Southern Cities in

2025 - 70% of CRE Investors Plan to Increase Acquisitions

in 2025 - Class B Apartments Lead Occupancy Recovery,

Surpassing Class C for First Time

December 2024 Newsletter

- 2025: A Rare Opportunity in Multifamily Investing

- Q3 2024 Sales Volumes Decline Amid Economic Uncertainty

- Why Are Americans Moving? Key Trends in U.S.

Relocation - Multifamily Investors Focus on High-Growth

Markets and Green Development - Investors Target Multifamily Despite Oversupply

Concerns

November 2024 Newsletter

- These Regions Will See the Highest Multifamily Rent

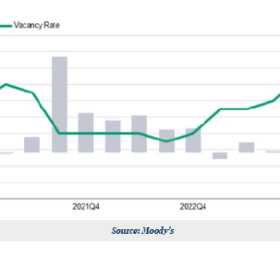

Growth in 2025 - U.S. Multifamily Market Sees First Vacancy Decline in Two+

Years - Sunbelt Multifamily Market Sees Renewed Demand as

New Construction Slows - Apartment Rents Continue to Fall as Record Supply

Dampens Market Growth - Apartment Rents Continue to Fall as Record Supply

Dampens Market Growth

October 2024 Newsletter

- Demographic Trends Point to Continued Strong HousingDemand

- Strong Apartment Demand Persists in 3rd Quarter as Supply Hits 50-Year High

- Strong Economy, Demand Boost Multifamily Optimism

- Impact of Interest Rate Cuts on Real Estate Cap Rates

- RealPage Predicts Cooling Apartment Demand Amid High Supply

September 2024 Newsletter

- Renter Preferences Shift Toward Home-Like Amenities in Apartment Search

- Multifamily Real Estate Market Update: Strong Demand Amid Surge in Completions

- Fed Rate Cut Boosts Investor Sentiment in Commercial Real Estate

August 2024 Newsletter

- New Real Estate Data Platform Launches in Miami

- Biden Administration’s Extended Renter-Friendly Policies Signal Key Trends For Investor

- Commercial Real Estate Investors Return to Market as Valuations Stabilize

- Property Insurers Retreat From Industrial and Multifamily Sectors Amid Market Softening

- Top Bull and Bear CRE Metro Markets: Investors Must Strategize Carefully

July 2024 Newsletter

- Average Apartment Sizes Increase

- Here’s Where Multifamily Rent Growth is Happening

- A Potent Sign that CRE Capital Markets Are Weakening

- Checking in on Our Favorite Markets in 2024

June 2024 Newsletter

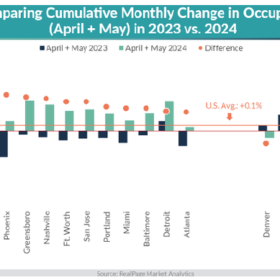

- Most U.S. Apartment Markets Recording Occupancy Improvement

- Rent Declines Are Definitely Decelerating

- Average Apartment Sizes Increase

- Here’s Where Multifamily Rent Growth is Happening

- A Potent Sign that CRE Capital Markets Are Weakening

May 2024 Newsletter

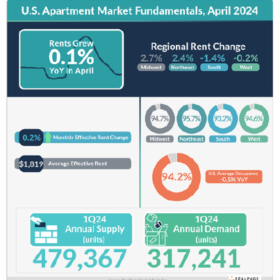

- Multifamily market Shows Signs of Stabilization, Offering Opportunities for Savvy Investors

- Rising Multifamily Insurance Costs: A Challenge for Affordable Housing

- Multifamily Rent Forecast: A Tale of Two Cities

- Multifamily Construction Boom: Hope for Renters?

- Key Takeaways from C&W’s Multifamily Management Strategies

April 2024 Newsletter

- Multifamily Starts Plunge: A Signal of Market Correction or Overreaction?

- Multifamily Market: Long-Term Optimism Despite Short-Term Headwinds

- Multifamily Market Shows Signs of Stabilization, Offering

Opportunities for Savvy Investors - Single-Family vs. Multifamily Rentals: Understanding Your Target Tenant

- Multifamily Market: Facing Challenges But Playing a Critical Role

March 2024 Newsletter

- Apartment Rents Show Tentative Signs of Recovery, Investors Advised Caution

- Austin Apartment Bust: A Boon for Renters, a Challenge for Investors

- PropTech Boom: Striking a Balance in Multifamily Investment

- DFW Metroplex: A Magnet for Investors Seeking Diversified Growth

- Job Growth Not Always Golden for Apartment Investors: A Look Beyond Headlines

February 2024 Newsletter

- Navigating Multifamily Markets: Opportunities Amidst Inventory Growth

- Multifamily Market Downturn: Navigating the Shift for Shrewd Investors

- Positive Turnaround for Multifamily Sector in 2024

- Apartment Sales Slowdown: Investor Insights for a Changing Market

- Covid Rent Debt Relief Ends: Multifamily REITs See Slow Improvement

January 2024 Newsletter

- U-Haul Growth States: Beyond the Headlines -Insights for Savvy Investors

- 4Q Apartment Demand: Insights for Investors

- Texas Job Growth Fuels Strong Investor Interest

- Navigating Commercial Real Estate Challenges

- Resilient Rental Havens: Unveiling the 6 Apartment Markets That Defied the Odds

January 2024 Week 4 Newsletter

• Texas Lease-Up Landscape: Top 10 Trends for Savvy Investors

• Apartment Market Shifts: A Landscape of Opportunity and Caution for Investors

• Fed Signals Rate Cuts, But Investors Brace for Uncertainty: A Balancing Act for Investors

January 2024 Week 3 Newsletter

- AI Boom Powers Data Center Expansion: A Strategic Guide for Investors

- Multifamily Slowdown: A Tale of Two Markets for Savvy Investors

- Commercial Real Estate Rebounds: A Strategic Guide for Savvy Investors in 2024

January 2024 Week 2 Newsletter

- A Brighter Dawn for Commercial Real Estate Insurance? Navigating the Shifting Landscape

- The Great Office Exodus: Navigating the New Landscape for Investors

- Nontraded REITs: Derailed or Divergent? Navigating the Investment Landscape in 2024

January 2024 Week 1 Newsletter

- Multifamily Slump vs. Single-Family Surge: Navigating the Shifting Housing Market

- Miami Heat: Rental Market Sizzles While Others Simmer -Investor Insights

- Rental Market Cools: A Silver Lining for Tenants, Cautious Optimism for Investors

December 2023 Week 5 Newsletter

- Multifamily Market: Navigating the Stormy Seas of 2024

- How Multifamily Investors Can Capitalize on Renter Financial Wellness in 2024

- Multifamily Gets Smart: How AI is Fueling Social Media Innovation

December 2023 Week 4 Newsletter

- San Francisco’s Building Boom: Opportunities and Challenges for Investors

- Navigating Multifamily Headwinds: Investor Insights from Lument Study

- Multifamily Market: Navigating Headwinds and Opportunities

December 2023 Week 3 Newsletter

- 2024: Brace for Impact in the Office Market – An Investor’s Guide

- Real-Estate Developers Chase Outer Space Business in Florida

- Rent Relief Redux: Investor Insights on the Reshuffling Rental Market

December 2023 Week 2 Newsletter

- Rental Concessions Reach Highest Level in Over Two Years

- Institutional Investors Warm Up to Resilient Retail Real Estate

- Florida’s Workforce Housing Surge: Boon for Investors, Mixed Bag for Locals

December 2023 Week 1 Newsletter

- High-End Apartments Facing Greatest Risk Of Oversupply

- Economic, Housing and Mortgage Market Outlook -November 2023

- Newmark: Spread Between Rent Vs. Own Accelerates

November 2023 Week 4 Newsletter

- Class-A Multifamily Rents Might Not Stabilize Until 2025,Analysis Finds

- Multilytics Forecasts Positive Rebound in Annual Class A Rent Growth by January 2025

- Apartments.com Celebrates Charitable Work in the Multifamily Industry

November 2023 Week 3 Newsletter

- Mortgage Rates Remain Elevated as Economy Surges ( Key Highlights for Investors)

- Promising Inflation Report Ushers in Favorable Mortgage Conditions for Homebuyers

- September Private Residential Construction Spending Inches Up

November 2023 Week 2 Newsletter

- Multifamily Sector Thrives Amidst Strong Demand and Tight Supply

- CBRE: Multifamily Deliveries Slow Rent Growth

- South Florida’s Multifamily Sector Exhibits Signs of Cooling Down

November 2023 Week 1 Newsletter

- Multifamily Office-to-Residential Conversions: A New Push from the Biden Administration

- 2 Arizona Cities Top the List of Best Places for Renters

- Multifamily Operators Report Increased Renter Expectations

October 2023 Week 4 Newsletter

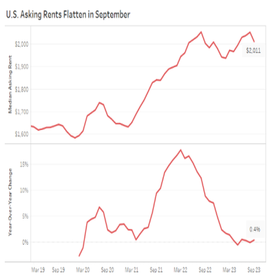

- Rental Market Tracker: Asking Rents Flattened in September Amid Growing Apartment Supply

- September’s Inflation Report: What It Means for Home buyers and Sellers

- Buy Your First Home: 4 Strategies for Affordability in a Challenging Market

October 2023 Week 3 Newsletter

- Top news: Arizona First-Time Home Buyer Programs and Loans

- Northeast Region Leads the U.S. in Rent Growth

- REITs vs. Real Estate Syndication: The 4 Key Differences

October 2023 Week 2 Newsletter

- Apartment Demand is Normalizing, But Soaring Supply Flattens Rents

- The Top 10 Markets Driving Rent Growth

- Multifamily Starts Plunge as Completions Increase

October 2023 Week 1 Newsletter

- The World’s Billionaires Are Betting Big On Multifamily in the United States

- Rent Now, Never Buy? Cities where it Makes More Sense to Pay Cheap Rent Than to Buy a Home

- MSCI: Apartment sales volume drops 74% YOY

September 2023 Week 5 Newsletter

- The Large Amount of Units Entering the Market is Being Absorbed by Apartment Renters

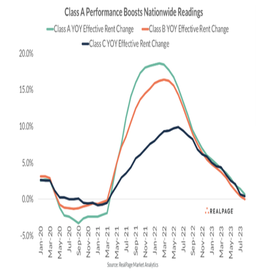

- Some apartment markets are suffering from Class A Rent Performance5

- Rent Growth Under Pressure from Florida Apartment Supply

September 2023 Week 4 Newsletter

- Competition for Apartments Intensifies in Midwest. This Rental Season, but Miami Holds Onto 1st Places

- Miami’s Apartment Market is Still Red-Hot as Florida’s Overall Competitiveness Dwindles

- A heads-up: Capitalizing on changing Fed policy and inflation

September 2023 Week 3 Newsletter

- Apartment Markets Across America Continue to Stabilize in 2023

- Higher Vacancy, Steady Demand for Multifamily

- Pullback in Multifamily Construction Starts

September 2023 Week 2 Newsletter

- Although rents are declining, the pace of decline is slower in the suburb

- Housing market factors may favor local retail and multifamily development.

- US Rental Markets Show Signs of Stabilization Amidst Ongoing Crisis

September 2023 Week 1 Newsletter

-

Austin Multifamily Properties on Target

-

What Do Accredited Investors Need To Know About Crowdfunding Today?

-

Help Investors Develop an ROI Strategy.

August 2023 Week 4 Newsletter

- Phoenix ranks No. 2 for the biggest decrease in home values

- Why industry growth attracted to Pinal County

- Unlocking Phoenix’s Housing Potential: Existing Vacant Land Could Hold Apartments for 93,000 Renters

August 2023 Week 3 Newsletter

-

International Real Estate Deals in the United States

-

Real Estate Insights: Demand for Apartments Reaches 5-Quarter High

-

DFW leads nation in apartment sales more than 30K units traded during first half of 2023

August 2023 Week 2 Newsletter

- Apartment Markets Across America Continue to Stabilize in 2023

- Rent is finally cooling. See how much price shave changed in your areas

- Multifamily Vs. Inflation: How to Safeguard Your Passive Investments

August 2023 Week 1 Newsletter

- TD Rent Growth: What It Tells Us About Apartment Demand

- Fort Worth: Sleeping Giant of D/FW Apartment Demand

- Oklahoma to be home to a $2 billion theme park, designed by over 20 former Disney builders and Imagineers

July 2023 Week 4 Newsletter

• Forecast Outlook for 2023 and 2024 in the Region

• What the SEC’s Accredited Investor Definition Means to You

• Three Types of Rentals Compete for Funds and Renters

July 2023 Week 3 Newsletter

• Peak Supply in Four Major Apartment Markets

• 5 Things Every Passive Investor Should Do Before Investing in a Real Estate Syndication

July 2023 Week 2 Newsletter

- What We’re Doing About Rising Commercial Property Insurance Cost

- How to Weather the Storm and Succeed with Real Estate Investments in a Recession

- Exploring the Shift: How the South is Becoming the New Epicenter of Economic Growth

June 2023 Week 5 Newsletter

Arizona Limits NewConstruction in PhoenixArea, Citing ShrinkingWater Supply

June 2023 Week 4 Newsletter

The Multifamily Sector’s Response to the FEDERAL RESERVE’S Interest Rate Pause

June 2023 Week 2 Newsletter

More Americans Could Soon Qualify to Invest in Private Securities

Read More

Subscribe to

Our Newsletter