4Q Apartment Demand: Insights for Investors

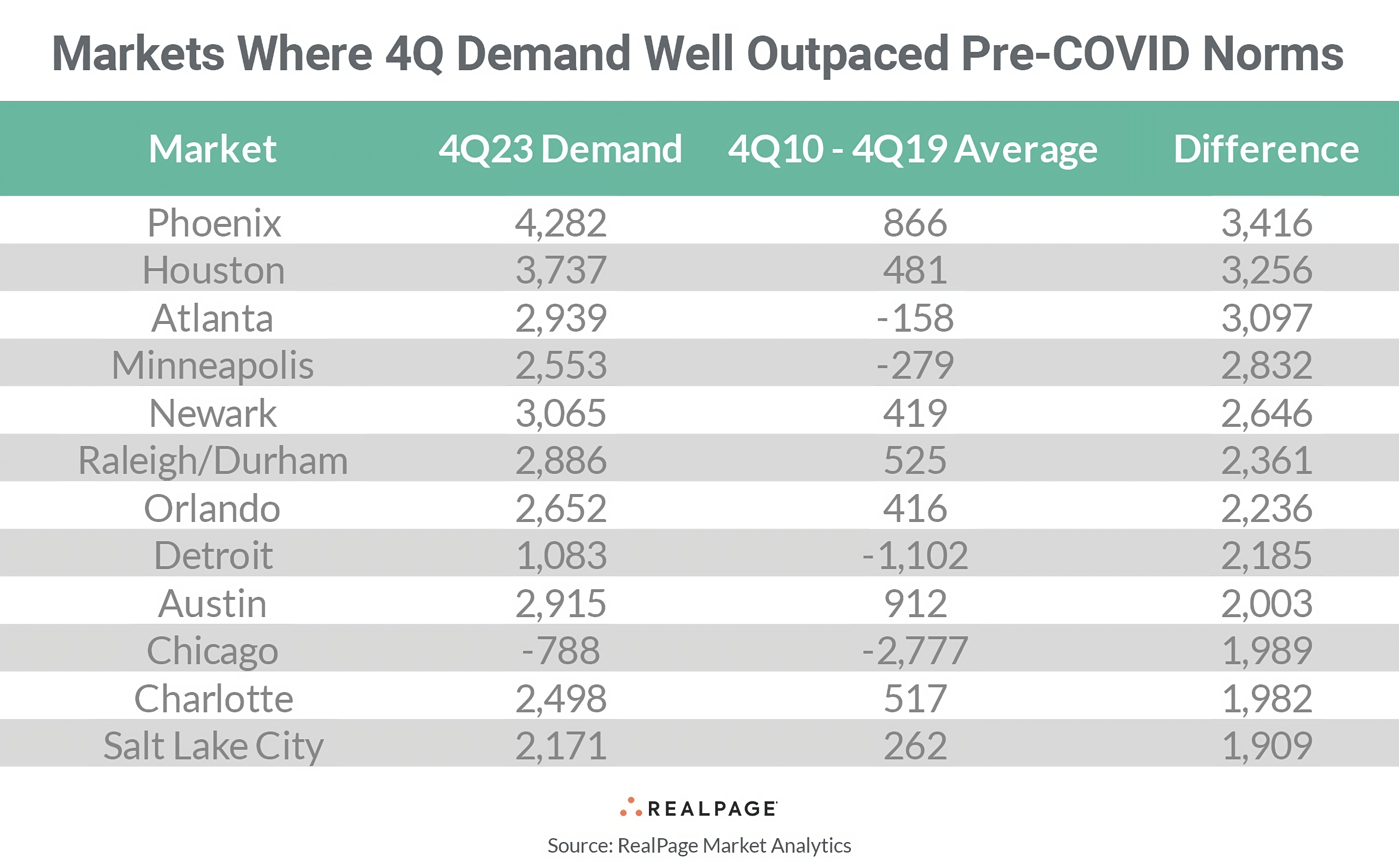

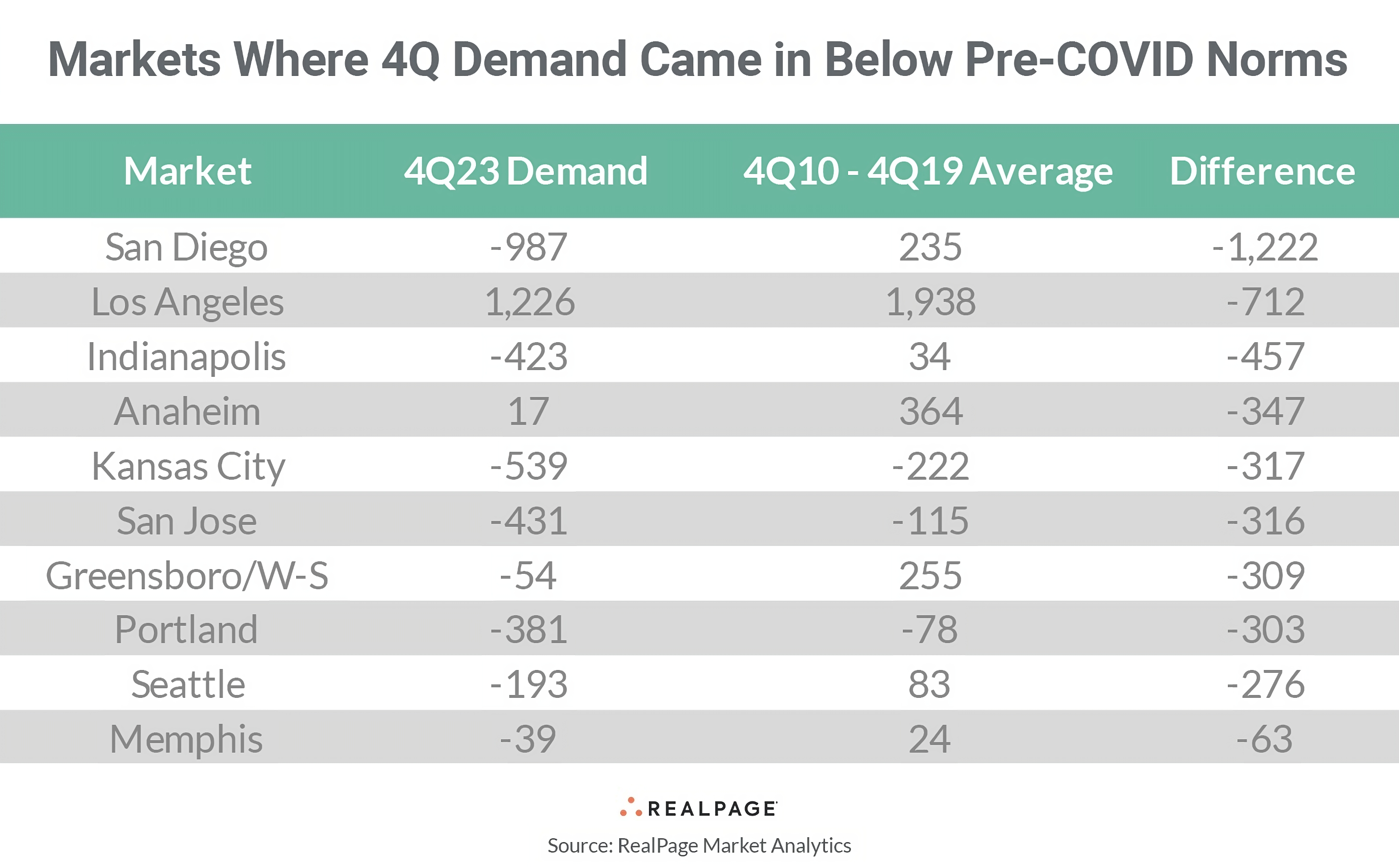

U.S. apartment demand in the fourth quarter of 2023 displayed strength, with some markets surpassing pre-COVID norms. Most notably, Sun Belt cities, experiencing robust population growth and job market performances, outperformed long-term demand averages. Phoenix stood out as a top performer, absorbing nearly 4,300 units in Q4 2023, a significant increase from the 2010-2019 average of less than 900 units. Houston and Austin in Texas also exhibited notable demand recovery. Conversely, markets like San Diego and Los Angeles faced challenges, with San Diego logging the worst demand performance among the top 50 markets, experiencing net move-outs of nearly 990 units in Q4 2023.

The data, sourced from RealPage Market Analytics, revealed that demand in 12 markets, including Phoenix, significantly outperformed long-term norms by at least 1,900 units. These markets demonstrated the strongest demand rebound, marking a positive trend for investors.

Evergreen Capital Key Insights:

Evergreen Capital notes that the robust demand in select markets, particularly those in the Sun Belt, underscores the potential for investment opportunities. The continued population growth, coupled with job market strength, indicates sustained demand for housing. Investors may find value in markets like Phoenix, Houston, and Austin, where the combination of job growth and increased demand presents favorable conditions. However, caution is advised for markets facing challenges, such as San Diego and Los Angeles, where demand struggles are anticipated in 2024 due to substantial completion volumes.

Evergreen Capital suggests investors carefully evaluate market dynamics, focusing on regions with strong demand fundamentals and potential for growth in the coming year. Understanding the unique challenges and opportunities presented by each market will be crucial for making informed investment decisions in the evolving landscape of the U.S. real estate market.